Finance is a vast term. In my opinion, it is the management of money or money-related transactions. Could be either for Money savings or investments. Finance from an academic point of view is a stream of study. For instance, an MBA in Finance, and an MSc in finance mostly deal with investments, mutual funds, hedge funding, investments, banking, etc. So, ‘Finance’ could be defined as the study of different types of money management.

Finance can also be defined as the science of money management. Management of money means the ways in which money is handled, rotated, and manipulated in order to make profits. Finance is “acquired” by some businesses, companies, and firms in the form of selling stocks or by accepting investments from investors or the public.

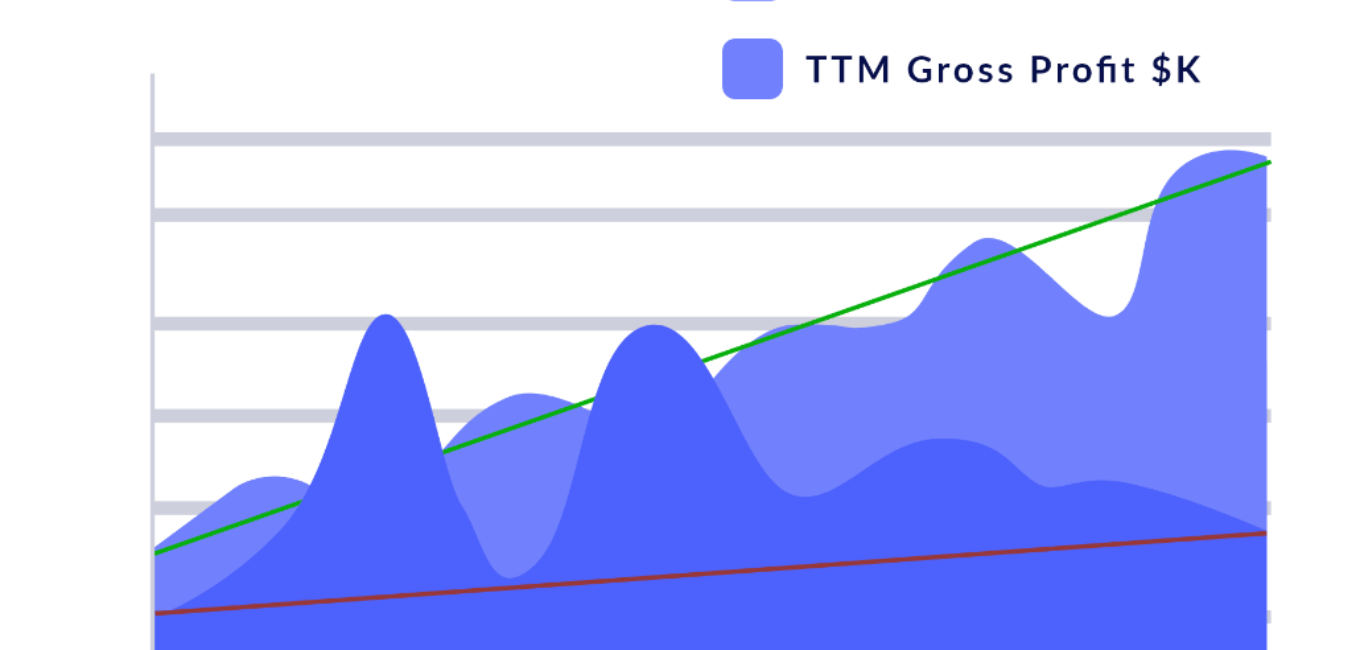

In finance, TTM means trailing twelve months, and it defines a company’s financial results in the last 12 months. For example, if the financial report relies on 12/ March/2020. Then economic and the USD dollar values used to design formed as trailing twelve months from April 1, 2019, till March 31, 2020.

It shows a peek at the ex (TTM) twelve trailing months of income. Companies can be studied and new information can be gathered quickly. Innovative businessmen will be happy if they take that mindset. It could create all the contrast for the new dealer who wishes to grow. The market is complete, and TTM Income can make the purpose of much further knowledge in time.

TTM Meaning

In finance terms, TTM stands for “trailing twelve months” and refers to figures that represent the company’s performance over the past year.

TTM Revenue describes the revenue that a company earns over the trailing 12 months (TTM) of business. This data is instrumental in determining whether or not a company has experienced meaningful top-line growth, and can pinpoint precisely where that growth is coming from.

A Trailing Twelve Month (TTM) chart depicts a company’s performance trend for a rolling 24-month period. Each dot on the chart represents a cumulative total for the 12 months immediately prior to that date.

Why Is TTM Important?

Why do we look at that? In finance, we’re interested in full-year periods. In three out of four periods in each year, a company doesn’t report its full-year cash flows. Only when they report a 10-K do they show you a 12-month period. For other reports, let’s say Q1, they show you a three-month period. In Q2, they’ll show you a three-month period and a year-to-date, six-month period. And in Q3, they’ll show you a three-month period and a year-to-date, nine-month period. But again, in finance, we’re interested in 12-month periods. So, a TTM calculation is necessary in three out of four periods in a year. And here’s how you calculate it.

Where to Find the TTM Measures

The 12-month measure is typically reported on a company’s balance sheet, which is customarily updated on a quarterly basis, in order to comply with generally accepted accounting principles (GAAP), although some analysts take an average of the first quarter and the last quarter.

Line items on the cash flow statement (e.g., working capital, capital expenditures, and dividend payments) should be treated based on the feeding financial statement. For example, working capital is compiled from balance sheet line items, which are averaged. However, depreciation is deducted from income on a quarterly basis; so analysts look at the last four quarters as reported on the income statement.

TTM Yield

TTM Yield. Used to analyze mutual fund or exchange-traded fund (ETF) performance, TTM yield refers to the percentage of income a portfolio has returned to investors over the last 12 months.

The dividend yield is a financial ratio that tells you the percentage of a company’s share price that it pays out in dividends each year. For example, if a company has a $20 share price and pays a dividend of $1 per year, its dividend yield would be 5%.

Compared to investment-grade corporate and sovereign bonds, high-yield bonds are more volatile with higher default risk among underlying issuers. In times of economic stress, defaults may spike, making the asset class more sensitive to the economic outlook than other sectors of the bond market.

High-yield bonds supply a consistent income stream that few other assets can match. And when high-yield issuers call their bonds before they mature, they pay bondholders a premium for the privilege. This helps compensate investors for losses suffered when some bonds default.

TTM and Equity Research

Public companies release financial reports on a quarterly basis in the form of securities filings. The part of these filings containing the financial statements features trailing 12-month metrics, updated quarterly per GAAP or generally accepted accounting principles.

“There’s no better gauge of a company’s prospects than how it’s performed over the last 12 months. TTM has stood the test of time as a powerful indicator of performance and potential,” said Larry Luxenberg, CFA, principal at New York-based Lexington Avenue Capital Management.

TTM is useful as a clear standard since sometimes firms will provide monthly statements detailing sales volumes or performance indicators, whereas Securities and Exchange Commission (SEC) filings present quarterly or YTD financials.

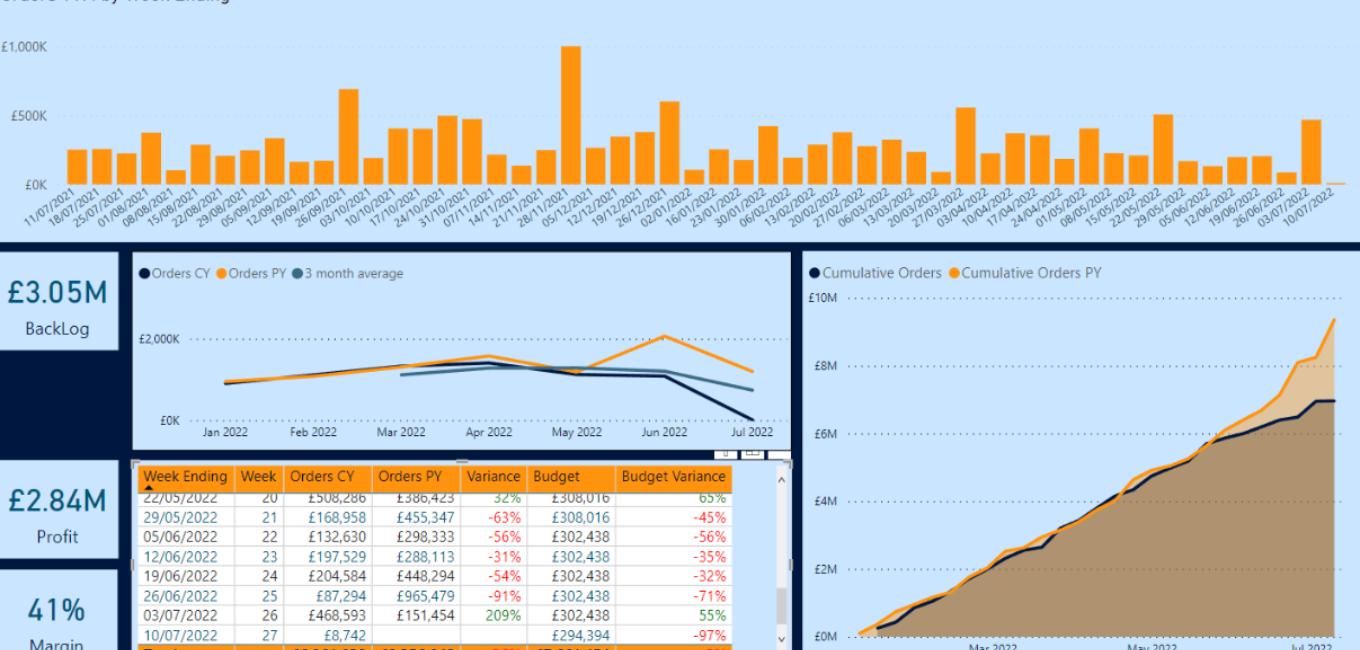

Financial performance

A company’s financial performance tells investors about its general well-being. It’s a snapshot of its economic health and the job its management is doing—providing insight into the future: whether its operations and profits are on track to grow and the outlook for its stock. Financial Performance in a broader sense refers to the degree to which financial objectives are being or have been accomplished and is an important aspect of finance risk management. It is the process of measuring the results of a firm’s policies and operations in monetary terms.

A financial performance analysis examines the company at a specific period in time—usually, the most recent fiscal quarter or year. The balance sheet, the income statement, and the cash flow statement are three of the most significant financial statements used in performance analysis. Financial performance analysis can focus on different areas. Types of analysis can include a specific examination of a firm:

Stock Valuation

Stock valuation is the process of valuing companies and comparing the valuation to the current market price to see whether a stock is over- or undervalued. Valuing stocks is a process that can be viewed as both an art and a science. The most common way to value a stock is to compute the company’s price-to-earnings (P/E) ratio. The P/E ratio equals the company’s stock price divided by its most recently reported earnings per share (EPS). A low P/E ratio implies that an investor buying the stock is receiving an attractive amount of value.

Investing has a set of four basic elements that investors use to break down a stock’s value. In this article, we will look at four commonly used financial ratios—price-to-book (P/B) ratio, price-to-earnings (P/E) ratio, price-to-earnings growth (PEG) ratio, and dividend yield—and what they can tell you about a stock.

Three main types of valuation methods are commonly used for establishing the economic value of businesses: market, cost, and income; each method has advantages and drawbacks.

FAQ’S

Conclusion

Trailing 12-month (TTM) figures report metrics based on the last 12 months (or four quarters) to date on a rolling basis. In addition to being used to measure recent trends or annual performance, TTM financial metrics are frequently used to compare the relative business performance of similar companies within an industry or sector.

Financial metrics commonly considered by looking at the last twelve months of figures include a company’s sales, stock returns, dividend yield, price-earnings (P/E) ratio, and earnings per share (EPS).